SMART Goals

One of the the frequently recommended paths to success is to have a SMART goal. To be a SMART goal, it must be Specific, Measurable, Achievable, Realistic, and Time-bound. At some point, I may look at the other letters of the acronym, but today I wish to focus on achievable and the path to achieving progress in any area.

The area of focus for our efforts is fundamental to whether any achievement is even possible. The area we choose must be a skill that we can practice and develop. Physical characteristics such as age and height are not skills, and thus are inappropriate targets for goals. The classic example is a short person wishing to play in the NBA, or middle-aged person attempting to join any of the professional sports teams, even golf. At a certain point, our bodies stop getting taller, and at least at this point, our medical knowledge cannot return to us the youth and vigor of our younger selves. Physical limits pose restrictions on our possible goals.

Trading, however, is a skill. There are no physical requirements to open a trading account beyond signing your name (or typing it) on a few documents. There may be limits to what realistic returns are, but progress is possible in the area of trading because it is a skill. The difficulty arises because trading is not just one skill, but a set of skills, and the deeper you dive into trading, the wider the skill set seems to expand.

Basic Skills

Any area has fundamental disciplines to study before one can be considered a master. I believe the most important skill anyone need to master for any area is that of learning. In his book, Principles: Life and Work, Ray Dalio provides several drawings similar to this one:

I’ve added my own labels, which are my reflections on the multiple presentations of the graph he makes in the book.

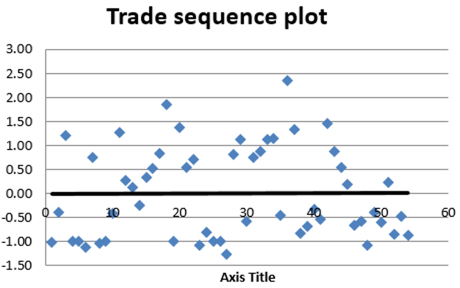

Improvement is generally shown as a line moving up and to the right. Time goes forward along the x-axis, and our progress up and down is plotted on the y-axis. An ideal equity curve just keeps moving up and to the right with no draw downs along the way. What I like about Dalio’s drawing is instead of a dip, there is a loop that occurs before progress can continue. This breaks the time axis metaphor, but I think it is more accurate for what we need to do to get out of those dips.

Problems

The first stumbling block on our road to success we will generically call a problem. Problems take many different shapes and forms, and will continue to accompany our journey throughout life. If we don’t find solutions, then we will simply spiral downward:

While problems seem like they take us off our path to achievement, I will assert that they are what enables us to achieve. Problems highlight areas that we have not mastered yet. They help us refine our knowledge and encourage us to acquire new skills that will take us to the next level.

How can you measure progress if you never hit any obstacles? Even most funds have some sort of benchmark to compare their performance against. (That’s the point of the Specific and Measurable part of SMART goals.) I am smart, and many things have come easily to me, but in the end, even that is a problem because I don’t know what (if anything) I’ve managed to achieve if I have nothing to compare my skills against. If no one else posted trade results or investment returns, I can only measure myself against my own yardstick (which may or may not be one yard long).

To grow, we must encounter problems. Our success is contingent upon finding the correct diagnosis and implementing a solution.

Diagnosis

Before we get to a solution, we have to identify what the problem is. Changing a light bulb when the power went out won’t get us any light back in the room. Problems arise because we have encountered an unknown. Identifying that unknown is the key to finding a solution. Sometimes the unknowns are outside of our control (for example: the death or resignation of a CEO, a product recall, or a power or internet outage). The best we can do is to make sure we have a plan that gives us a path forward and enables us to live to trade another day.

Sometimes, the problems are interior. Our beliefs may be staging their own battle. Which is more important, honoring our stop or cashing a winner? Entering a new trade or not losing money? External problems are usually easy to diagnose. Internal problems may be more difficult to correctly solve. Because we are facing the unknown, we may need to try several different solutions before we find the best one for the problem. There may also be side effects caused by the solution that provoke other problems. As a concrete external example: moving a table so that we don’t bump into it while walking through the living room might seem like a good idea until we sit down in our favorite chair and no longer have a place to put our coffee.

Diagnosis is also an area where it can be helpful to have other people involved. Teachers and mentors can point towards possible solutions or give us information that we need in order to move on to the next level. Most often, our problems are not unique. Other people have been there and done that. Colleagues and friends can share their answers or the information that they have found helpful in solving problems. Even if the problem is an internal one, it’s quite useful to seek out others to help in the diagnosis and solution stages.

Solutions

After encountering a problem, correctly diagnosing it, it’s time to implement the solution. If the solution is not a one-time-fix-it-and-it’s-done solution, then an accountability partner might be useful. A teacher or mentor might also guide in the implementation of the solution. The first solution also may not solve the problem. It’s entirely possible to spin around the loop several times before progress up and to the right resumes. Like a roller coaster, the downward drop can give us energy to move back up. When we find the right solution, we often have more enthusiasm and drive to continue our journey. Having conquered a problem, we have new confidence to move up to the next level. This is the real joy of solutions.

The Path to Achievement

Growth in any area requires that we master the loop of problem-diagnosis-solution. Whether the skill we wish to master is trading, playing piano, or a new language. We take steps forward until we encounter a problem, some task or situation that we have have not encountered before. We must then identify the roadblock and find a way around it before we can continue on the path to achievement and mastery. If the solution we choose is not adequate, we may encounter the problem again, but this only means that a new and better solution is waiting to be found.

There are many different skills required to master trading. At the foundation though, I believe is the ability and willingness to move through the cycle outlined above. Only by looking for progress, identifying the areas for growth and implementing new information can a skill be mastered. This is the record of my journey as a trader, my reflections, observations, and an account of my actions as I walk the path to becoming the best trader I can.