Spreadsheet Day 2

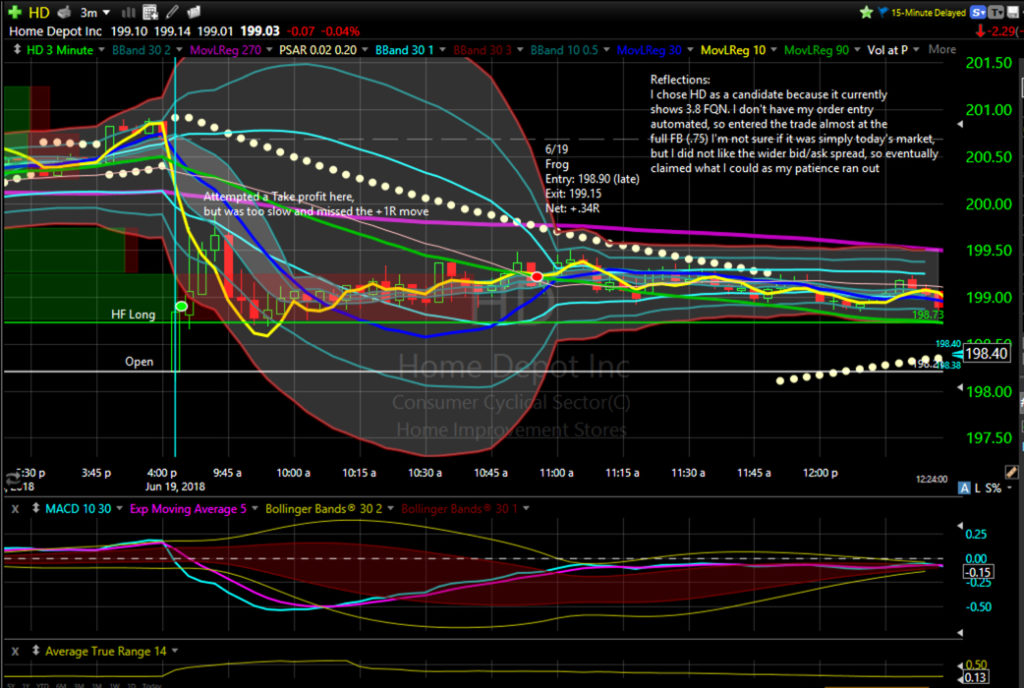

With what I learned yesterday, I was a little more prepared today to enter orders from the spreadsheet. I had already pared the list of targets down and chose to enter orders manually as quickly as I could for the targets that fired first. I ended up placing trades in XLV, HD, AXP, XLU, and JNJ. It was hectic transferring the entry orders and position sizes manually from the spreadsheet because the market was moving quickly. Here are the charts of the trades:

While I feel there is definitely room for improvement in what I managed to do today, the results (+2.25R) for the 6 trades were certainly acceptable. I may be stretching my span of control by following so many possible targets, but as long as I am paper trading this idea, I will continue to enter as many as I can manage so that I can look for other qualities to screen on the spreadsheets to help give me another edge.

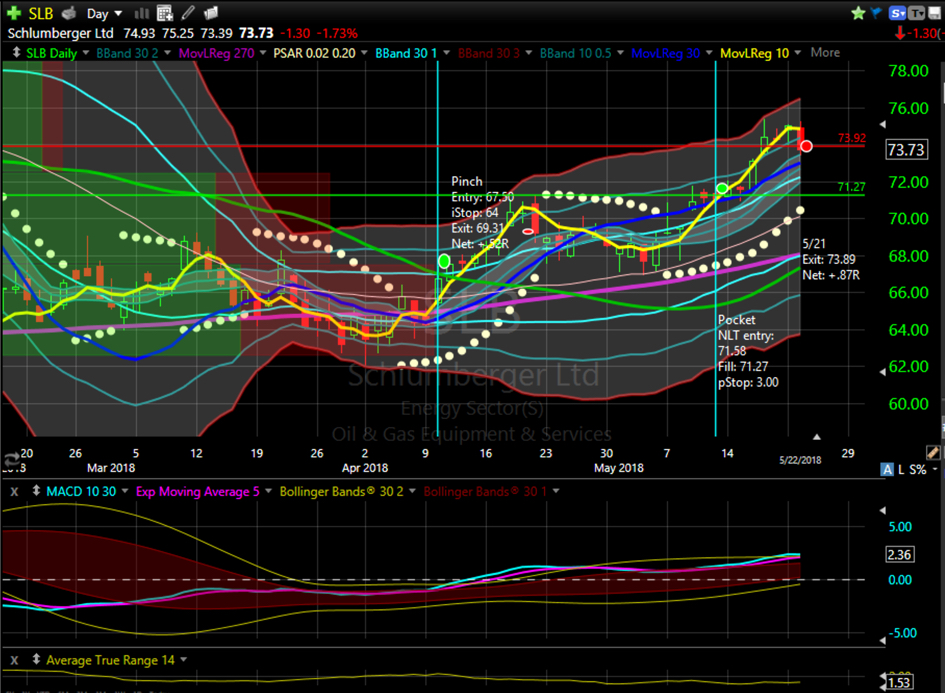

Swing Trades

No swing trades were opened today. The double position in CAT was stopped out as well as OKTA. Net for the three positions was -1.51R. when combined with the day trades above, that gives me +.75R for the day.

Long: AWK, CVX, FCX, GIS, JPM, MKC, RIO, TLT, VPL, XME.

Short: XES.