Daily Reports

It’s been a few days since I have been able to post because I was traveling. I was not sure what sort of internet access I would have or how much time I would have to devote to trading, but I was hopeful that I will be able to do my basic 30 min to one hour routine. That didn’t happen, so I’m playing catch up tonight. The charts would be too numerous to post here as I’ve closed out 27 trades since my last report, so I’ll stick to the reflections on my experiences and the next steps I plan to take.

Day trades

On 20 June 2018, I was able to place day trades, building off of my experience using the spreadsheet I’ve built. Recognizing that entering orders was a difficult part of the process, I decided to prefill orders with the size and type for each of the potential trade candidates. Once the market opened, I would then only need to fill in the appropriate price. These seemed like a potentially quicker method, but I tried to be too efficient and added stop and take profit orders as well. This made for an overwhelming order screen. Because I could not adjust all three prices (entry, stop and profit) quickly, I ended up canceling all the stop and take profit orders. This cleaned up my screen, but not before I made some order entry mistakes. I sold at least one stock when I was supposed to enter long. I happened to profit on that trade, but I also had a trade run to -1.5R before I got out because I didn’t have the stop in place and wasn’t watching carefully. With 14 trades, I netted +.17R.

Day trading lessons learned

I tried to push my span of control by pre-entering orders. I got more trades, but not better returns. I either need to figure out better order entry method and/or reduce my possible target set. I also have been placing all these trades without looking at a chart. It’s possible that there are other signals I would have seen on a chart that would have cut some of my losses sooner. If I reduce the number of possible targets, I should be able to better manage the orders and watch the chart. While this will limit my data sample, it will increase my accuracy, which should lead to an increase in my bottom line. My intention for 2018 is to be more focused. Here is another example of where I need to be less scattered, even as I am focusing on one technique. Living to trade another day is better than practicing mistakes and creating bad habits. I don’t need to catch all the possible trades. I need to execute my plan and let the trades take care of themselves.

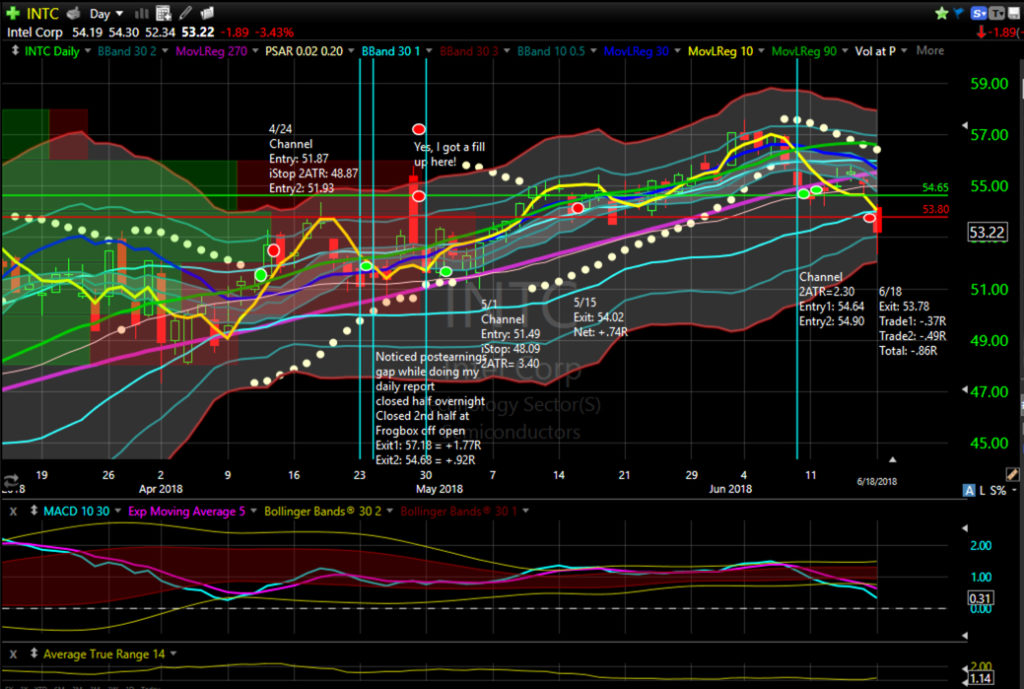

Swing Trades

Eight swing positions were opened since the last update. Four of those were closed yesterday, and four remain open. Overall 13 trades were closed for -8.27R. Only one trade closed for a loss greater than -1R, and that was just -1.04 because it opened above the stop (it was a short). Market conditions turned unfavorable for swing trading at the end of the week, and because I was not watching closely, several of these trades went all the way to full -1R losses because I never adjusted the original stop. I believe some of the losses would have been smaller if I had paid better attention to what was happening. I do not expect to initiate any swing trades for the next few days unless they are residual portions of successful day trades. I will be more ruthless in my stop management for the remaining swing trades that are open. Seven positions are open showing a combined +.36R

Long: AAPL, CME(2), GIS, MKC, TLT, X.

Short: none.