Swing Trades

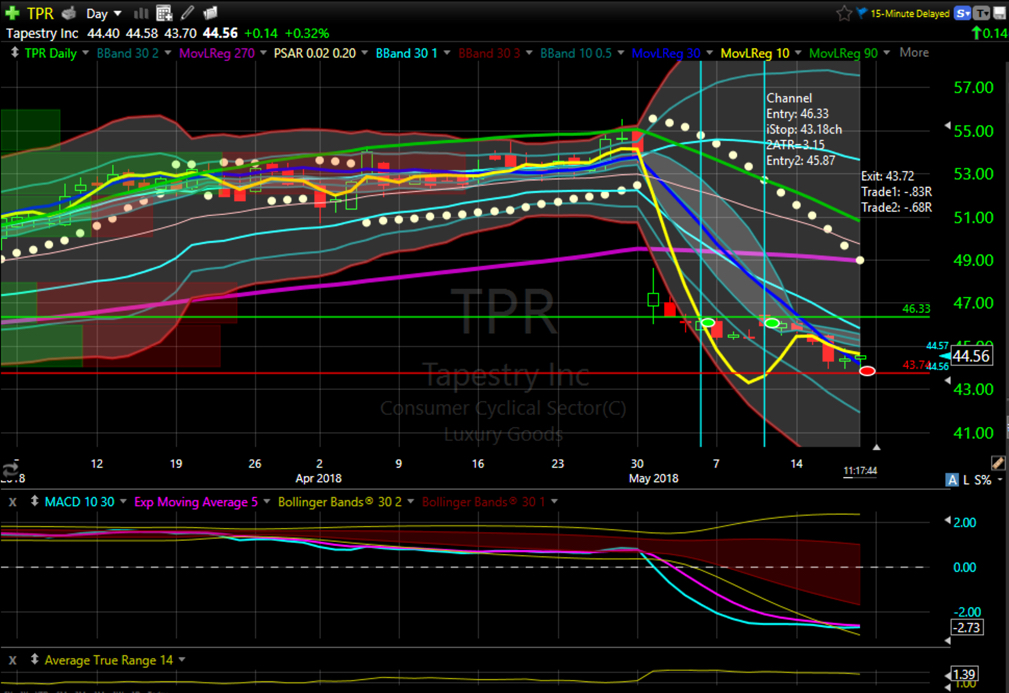

Three trades were framed for today, all channel system trades, so they were all filled at market open. Two stocks hit stop losses and were closed, removing three positions. Total return for the three: -.18R.

Current holding 20 open trades showing +2.14R.

Long: AA(2), CAT, CBOE, CSCO, DIS, EWI(2), GILD, HD, IR, KR, MSFT, PFE, SLB, STZ, WYNN(2), XME.

Short: SKT.

Day Trades

I missed the market open today, but was able to watch for a few select windows of time. The first trade went all the way to +1R, though I missed capturing that by just a couple of points. The other two times I exited when I needed to walk away from the screen. If the trades had been solidly in the green, I might have been willing to put in a trailing stop. Net results for 4 trades; +1.43R.

Reflections

Today seemed to be a back and forth sort of day. I feel fortunate to have caught one of the larger swings on my first trade. It was interesting to notice the possibility of closing trades before they developed as I had hoped. Fridays can sometimes lead to big moves, but this was a quiet one. Knowing the markets I perform worst in are the ones headed into sideways quiet, I was happy to be out of the market most of the time. Follow the process and let the results take care of themselves.